Content

Net realizable value analysis is a way to check the balances of assets on a company’s accounting books to ensure they are properly valued under the theory of conservatism. NRV is most often applied to inventory but can be brought to bear on any asset, such as accounts receivable, fixed assets or investments. NRV is a common method used to evaluate an asset’s value for inventory accounting. Reporting of the cash realizable balance is required under the accrual basis of accounting, since a reporting business must report a reserve for its estimated uncollectible receivables.

Variance Analysis Variance analysis is a method for companies to compare its actual performance vs its budgeted amount for that cost measurement . The differences between the standard amount of cost and the actual amount that the organization incurs is referred to as a variance. The Coca-Cola Company , like other U.S. publicly-held companies, files its financial statements in an annual filing called a Form 10-K with the Securities & Exchange Commission . Determine a required payment period and communicate that policy to customers.

How to Determine Net Sales From Cash Receipts & Disbursements

For convenience, accountants wait until financial statements are to be produced before making their estimation of net realizable value. The necessary reduction is then recorded by means of an adjusting entry. By establishing two T-accounts, a company such as Dell can manage a total of $4.843 billion in accounts receivables while setting up a separate allowance balance of $112 million. GAAP—is the estimated net realizable value of $4.731 billion. Net realizable value, as discussed above can be calculated by deducting the selling cost from the expected market price of the asset and plays a key role in inventory valuation. Every business has to keep a close on its inventory and periodically access its value.

Amounts currently held by an organization as cash in addition to amounts that will provide future receipts or payments of a specified amount of cash. Group of individual accounts whose sum totals a general ledger account balance. The success of the conveyance is dependent on the ability of an organization’s accountants to prepare financial statements that meet this rigorous standard. Analysts carefully monitor the days outstanding numbers for signs of weakening business conditions. One of the first signs of a business downturn is a delay in the payment cycle.

What Affects Net Realizable Value

For inventory or physical assets, this might involve estimating transportation costs, advertising, commissions or packaging. For AR, “disposal costs” could include legal fees or collection agency commissions. Net realizable value is an approach to valuing assets fairly — and conservatively. It applies to all reporting under both Generally Accepted Accounting Principles and International Financial Reporting Standards .

- Use of the direct write-off method can reduce the usefulness of both the income statement and balance sheet.

- If you need to value an asset, be sure to consider all of the different valuation methods before making a decision.

- All other account balances reflect historical events and not future cash flows.

- We can calculate this estimates based on Sales for the year or based on Accounts Receivable balance at the time of the estimate .

- Since the carrying value of the machine is lower than the NRV, we will keep on reporting the machine at its carrying value.

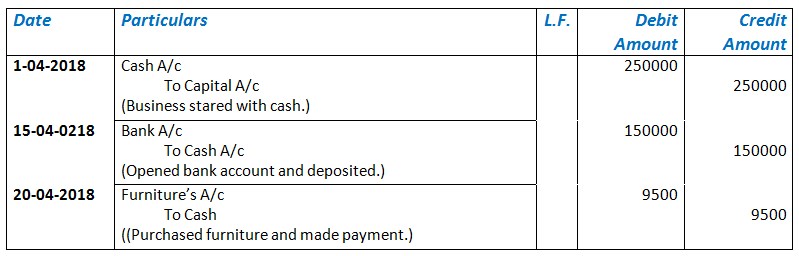

NRV for accounts receivable is calculated as the full receivable balance less an allowance for doubtful accounts, which is the dollar amount of invoices that the company estimates to be bad debt. The second entry records the customer’s payment by debiting cash and crediting accounts receivable. Most companies record cash receipts in a cash receipts journal. Since a special journal’s column totals are posted to the general ledger at the end of each accounting period, the posting to J.

Reduced Reliance on Credit

In a promissory note, the party making the promise to pay is called the maker. Leon’s parents have decided to charge rent after seeing how successful his business is and how much space it is taking up in their house. ____ The older a receivable, the less likely it is to be collected. Give two reasons why accountants do not restate prior year statements when estimations are not exact. The higher the receivable turnover, the faster collections are being received. Recognize that transactions denominated in a foreign currency are now quite common.

Decisions have already been made by investors and creditors based on the original data and cannot be reversed. These readers of the statements should have understood that the information could not possibly reflect exact amounts. Each year, an estimation of uncollectible accounts must be made how to calculate cash realizable value as a preliminary step in the preparation of financial statements. Some companies use the percentage of sales method, which calculates the expense to be recognized, an amount which is then added to the allowance for doubtful accounts. Other companies use the percentage of receivable method .

Set your financial reporting on autopilot. Goodbye manual work.

Bad Debts Expense is reported under “Selling expenses” in the income statement. Both the gross amount of receivables and the allowance for doubtful accounts should be reported. To illustrate the basic entry for notes receivable, the text uses Brent Company’s $1,000, two-month, 12% promissory note dated May 1.

Accounts receivable is a control account that must have the same balance as the combined balance of every individual account in the accounts receivable subsidiary ledger. For tax purposes, companies must use the direct write‐off method, under which bad debts are recognized only after the company is certain the debt will not be paid. Before determining that an account balance is uncollectible, a company generally makes several attempts to collect the debt from the customer. Recognizing the bad debt requires a journal entry that increases a bad debts expense account and decreases accounts receivable. Smith fails to pay a $225 balance, for example, the company records the write‐off by debiting bad debts expense and crediting accounts receivable from J.

We are going to continue with this problem, preparing Webworks financial statements for July. Be able to perform lower of cost or net realizable value method computations. Webworks pays off its accounts payable and salaries payable from June.

- Once again, though, absolute assurance is not given for such reported balances but merely reasonable assurance.

- Often, a company will assess a different NRV for each product line, then aggregate the totals to arrive at a company-wide valuation.

- As part of this filing, Volkswagen disclosed the nature of the calculation of its inventory.

- To illustrate, assume that a company makes sales on account to one hundred different customers late in Year One for $1,000 each.

- This amount represents the required balancein Allowance for Doubtful Accounts at the balance sheet date.

How do you calculate realizable value?

It is found by determining the expected selling price of an asset and all the costs associated with the eventual sale of the asset, and then calculating the difference between these two. To put it in formulaic terms, NRV = Expected selling price – Total production and selling costs.